(adsbygoogle = window.adsbygoogle || []).push({});

Getty Images

Getty ImagesSince the government unveiled its new inheritance tax plans for farmers in last month’s Budget, there has been intense debate about how many people will be affected and to what extent.

Many of the claims from the government have been hotly contested by farmers, and BBC Verify has come under scrutiny over some of the figures it has relied on to try to establish the number of farms impacted by the change.

The debate has revolved around estimates provided by farmers’ groups, including that the new tax could “harm” up to 70,000 farms over time.

Our analysis found that the figure was likely to be somewhere closer to the number provided by the government – about 500 estates per year. That remains our assessment.

Farmers’ groups say the changes have been “built on bad data”. The government says it wants to make the inheritance tax system fairer and discourage wealthy people from investing in land solely to avoid the tax.

Here, we go through all the numbers and examine the claims and counter-claims.

What are the contested figures?

Under the government’s plans, from April 2026, inherited agricultural assets worth more than £1m, which were previously exempt, will be subject to inheritance tax at 20%.

The Country Land and Business Association (CLA) has estimated that the tax change “could harm” 70,000 UK farms. This would represent roughly 33% of the 209,000 UK farms, as identified by the Department for Environment, Food & Rural Affairs (Defra).

The CLA figure is not an annual one and, clearly, a farm would only be potentially subject to inheritance tax if it was passed on, following a death.

The government, in trying to assess the impact of its tax change, looked instead at recent figures for the number of actual claims for tax relief for agricultural estates.

At this point, it’s worth stressing that an agricultural estate is not the same as a landed estate, or farm: an “estate” is a legal term for the value of the money, property and possessions an individual passes on upon their death. In this case, it’s an estate that includes some agricultural land.

The Chancellor, Rachel Reeves, has claimed up to about 520 inherited agricultural estates a year “will be impacted to some extent by these changes”.

The Environment Secretary Steve Reed has said “three quarters of farmers will pay nothing as a result of the changes”.

But farming groups continue to dispute the government figures, with the National Farmers’ Union (NFU) pointing to other figures from Defra which it says “show that only 34% of farms are under £1 million net worth”. This would imply that around two thirds of farms could potentially be affected by the Budget tax change.

The NFU has also released analysis which it says shows that “around 75% of commercial family farms will be above the £1 million threshold”.

Below, we look into the challenges when it comes to reaching an exact conclusion on the numbers affected, and provide more detail on which figures are more reliable – and explain why.

Is Defra data more accurate?

Farming groups have partially based their arguments against the tax change on data from Defra’s Farm Business Survey, which shows the net worth of farms in England in 2022/23.

The figures suggest that 17% of farms in England have a net worth – the difference between their assets and liabilities – of between £1m and £1.49m. Another 49% of farms have a value of £1.5m and over.

This suggests, on the face of it, that 66% of farms in England could potentially be affected by the tax changes.

Getty Images

Getty ImagesHowever there are some problems with this calculation, as the data from the Defra survey is not necessarily representative of the overall UK-wide farming sector.

The survey – which is based on a sample of just over 1,350 farms – states that it is designed to be representative of only about half of the farms in England (rather than the rest of the UK) and also excludes farms which bring in little revenue.

Moreover, the Defra data shows estimates of individual farm values, but does not show their ownership.

Multiple farms can be owned by a single person who then lets them out to tenants. In England about 46% of agricultural holdings were wholly or partially rented out to tenant farmers in 2023 according to Defra data. If the owner of multiple farms sought to pass on those farms upon his or her death, this would all show up in a single estate in the inheritance tax relief claim.

The financial impact would be on that individual’s inheritance tax bill, not each farm.

A farm could also be jointly owned by multiple people. If, for example, five people owned a £5m farm they could each pass on their £1m share without their estates having to pay any inheritance tax.

This is why it is more appropriate to use tax data on inheritance relief, rather than farm survey data, to estimate the impact of the change in the Budget on individuals.

Does including business property relief change the picture?

Another challenge is that some initial government calculations of the number of estates likely to be affected only referred to Agricultural Property Relief (APR) and not Business Property Relief (BPR).

APR relates mainly to the value of land. BPR can include a farm’s machinery and livestock, which can also make up a significant proportion of the value of an agricultural estate.

It is true that both APR and BPR relief will be capped at a combined £1m for inheritance tax purposes, meaning a single estate will be able to claim no more than £1m in these combined reliefs.

Farming groups have claimed that farmers often also use BPR so any calculation of the impact of the tax changes based solely on APR claims will not capture the full effect on farming estates.

However, the government has now published figures based on HMRC inheritance tax data which incorporate historical APR and BPR relief claims, and should capture those agricultural estates making use of both reliefs.

These figures suggest that while taking BPR into account as well as APR does push up the number and proportion of estates likely to be affected, it does not fundamentally change the picture.

The data shows that in 2021-22 the number of estates making combined APR and BPR claims where the value of the estate was more than £1.5m was 383, or 22% of all claims.

The number of estates worth more than £1.5m making APR claims solely was 278, or 16% of the total.

Why is it £1.5m and not £1m?

The government’s latest figures break down the impact using the threshold of £1.5m, not £1m, explaining to BBC Verify that this was chosen based on the assumption that an individual estate’s standard inheritance tax reliefs of £500,000 would be added to their new £1m allowance.

BBC Verify asked the Treasury and HMRC for a breakdown of the figures using £1m as a threshold – which would be consistent with its original calculations showing APR claims only – but it said it hasn’t collated those figures.

The CenTax think tank has studied the impact of APR and BPR reliefs.

CenTax’s co-director Arun Advani argues that the government’s estimates of the number of agricultural estates likely to be affected by the capping of both reliefs at £1m combined – up to 520 estates a year – seems reasonable.

“The data on historic claims are a much more reliable guide to the number of affected estates than surveys of farm sizes,” he said.

“While the government’s reforms are certainly likely to be difficult for some farmers, particularly given the many other factors weighing down farmer’s incomes, numbers claiming tens of thousands will be affected aren’t consistent with the evidence.”

David Sturrock from the independent Institute for Fiscal Studies also said that the Treasury’s figures were “credible” and added that including the impact of capping BPR “doesn’t radically change the picture in terms of estates affected”.

The NFU has pointed out that if 500 estates were affected per year that could amount to 15,000 over 30 years – but this would still be some way short of the 70,000 figure.

Should small estates be excluded from calculations?

The NFU argues that many estates included in the government figures are too small to be considered working farms.

Its case is simple – if you were to exclude these small farms, the percentage of real, working farms affected would be much higher.

It has pointed to separate APR inheritance tax relief claims data from HMRC, via the Treasury, which breaks down estates by size.

This shows that in 2021-22, 474 claims (27% of the 1,730 total) were for estates valued between £0 and £250,000, and that 398 (23% of the total) were for estates valued at between £250,000 and £500,000.

“Very few viable farms are worth under £1m,” says the NFU president Tom Bradshaw.

Getty Images

Getty ImagesThat’s a reasonable argument.

If estates with a value below £500,000 were excluded from the APR figures, the share of the total affected each year would automatically rise from the 27% implied by the government’s initial calculations.

The NFU’s analysis suggests only including what it categorises as “working farms” would increase the share affected from 27% to 49%.

However, the estimated absolute number of affected estates – roughly 500 in each year – would not be affected by that change.

Is there a £3m allowance?

A key question is where the effective financial inheritance tax threshold for estates with agricultural assets kicks in.

Farming groups have suggested the value of any inherited estate with agricultural assets over £1m will be impacted.

This is understandable as this was the threshold figure cited in the Budget.

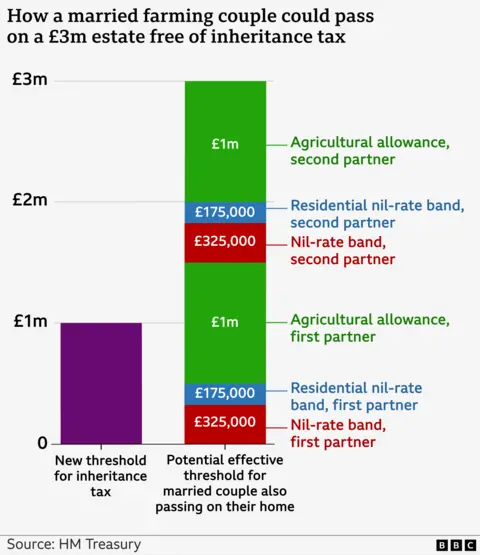

However, the government has since claimed that the effective threshold for many farmers’ estates to pay inheritance tax could be not £1m, but £3m, because of various inheritance tax reliefs available to estates.

A higher effective threshold would have a major impact on the proportion and number of estates affected.

The overnment’s claim is based on the fact that the estates of farmers, like the estates of everyone else subject to inheritance tax, are eligible for a standard tax-free allowance, known as a nil-rate band, of £325,000.

They are are also eligible for the residential nil-rate band of £175,000. The latter is available to people who are passing on a main residence to a direct descendant, such as children or grandchildren, as part of their estate. Together these two allowances total £500,000.

This is on top of the £1m tax-free allowance for agricultural estates.

It’s not just the £1.5m allowance for a single individual – for anyone married their spouse has a similar effective allowance. Adding these together – and allowing for the ability of farming couples to share their allowances – does create a potential for some farming estates to pass on £3m entirely free of inheritance tax.

However, importantly, this could only be achieved if each partner passed on £1.5m of their total assets at death sequentially, rather than in one £3m estate upon the death of the second partner.

The ability of estates to push up the threshold to £3m will also depend on individual circumstances. Of course, not every farmer is married, and some might not be passing on a main residence.

However, it’s legitimate to assume that many farming estates would be able to use these allowances, which are used by the rest of the population.

Finally, it’s worth noting that a farming estate can be affected by this inheritance tax change, without the estate necessarily ending up paying more money in tax, because of the need for individuals to spend more time planning their tax arrangements than they did before.

(adsbygoogle = window.adsbygoogle || []).push({});